Are you hiring?

Learn what the Work Opportunity Tax Credit (WOTC) may look like for you

By submitting your information, you agree to Arvo’s Terms of Service and Privacy Policy. You can opt-out anytime.

What is the work opportunity tax credit?

The Work Opportunity Tax Credit (WOTC) is a federal program for employers large and small. It encourages the hiring of targeted groups of workers who historically struggled to find employment.

%

of new hires qualify for WOTC credits

%

improvement on cashflow for your business

$2,150

per eligible new hire on average

See how others have benefited from WOTC

Staffing

Locations: 13 sites

New Hires: 2789

WOTC Credit Received: $217,823

New Hires: 2789

WOTC Credit Received: $217,823

Restaurant

Franchise Locations: 8

New Hires: 374

WOTC Credit Received: $33,280

New Hires: 374

WOTC Credit Received: $33,280

Construction

Locations: 9 Sites

New Hires: 208

WOTC Credit Received: $51,120

New Hires: 208

WOTC Credit Received: $51,120

Call Center

Locations: Work From Home

New Hires: 798

WOTC Credit Received: $241,490

New Hires: 798

WOTC Credit Received: $241,490

See what you could earn

This calculator is based on actual data from clients we’ve assisted. Your credit could be higher or lower. This calculator serves to provide a realistic idea of what you can expect.

Savings$

How it works

Step 1

Screen your applicants

Our digital WOTC survey fits seamlessly into your application or onboarding process

Step 2

Certify Eligibility Employees

Eligible employees must then be certified by the state. Arvo works on your behalf to ensure all eligibility employees get certified

Step 3

Track Credit Earned

Our state of the art WOTC portal provides real-time information and reporting on the health of your WOTC program

Step 4

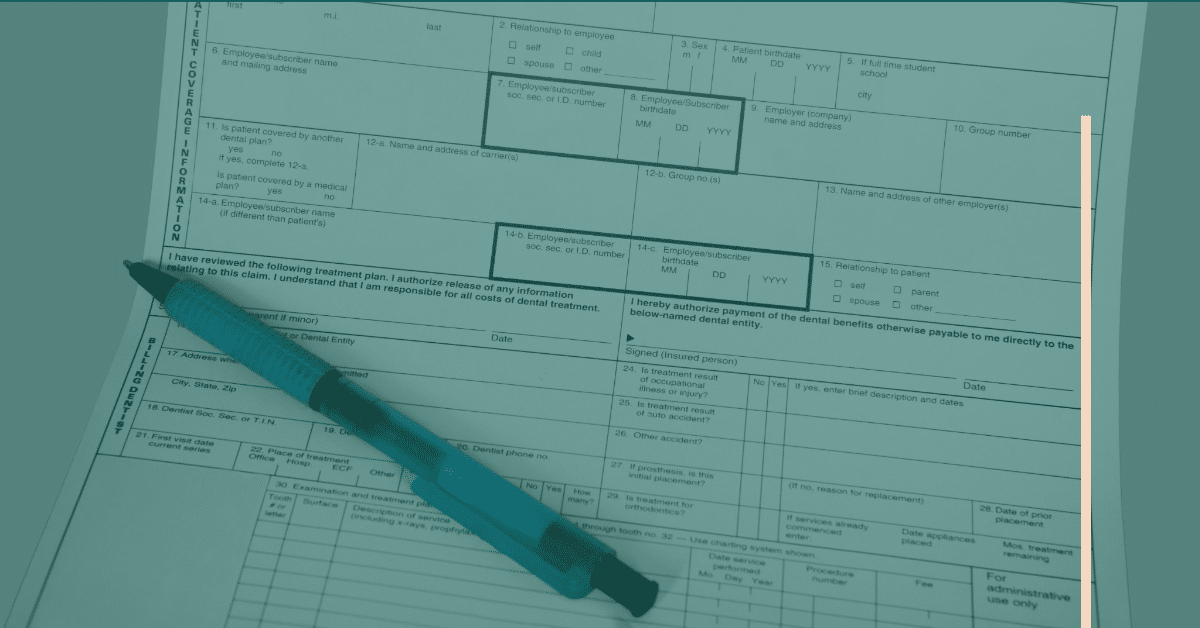

Claim your tax credit with the IRS

Before filing your tax return each year, we’ll complete the necessary tax form for your CPA